Content

Apply all or the main number online 101 to help you your estimated income tax to have 2025. Get into on line 102 the degree of range 101 you desire applied to 2025. To the Allege away from Right borrowing, stick to the revealing guidelines within the Agenda California (540NR), Area III, line 16 beneath the Claim of Best.

If you make the one-day QCD so you can a keen SIE, you need to install a statement for the return. 590-B to have information on QCDs, such as the information you need to is to your accessory to possess QCDs so you can an SIE. Should your person is married and you will data a joint return, you can not point out that people as your centered. Yet not, should your body’s married however, cannot document a combined get back or data a mutual go back in order to allege a refund from withheld tax otherwise estimated tax paid, you are capable declare that people while the a depending. (See Club. 501 for facts and you will instances.) If that’s the case, see 2, question step 3 (to have an excellent being qualified kid), or Step, matter cuatro (to have a qualifying relative).

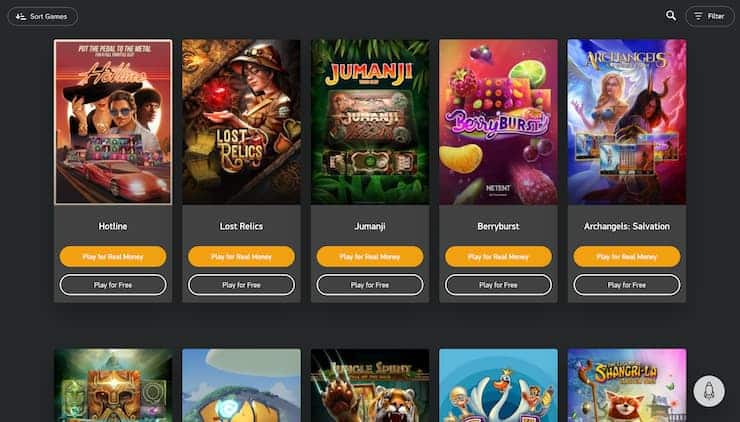

However, being qualified to own multiple bonuses at the same time at the same lender usually isn’t you are able to. Savings account incentives are usually readily available simply to the newest examining otherwise savings account holders. The low money requirements make sure they are a knowledgeable bunny boiler gambling enterprise place to start people one managing a finite money, and first just who’re also getting to grips with to your-line gambling enterprise play.

Armed with a BA Honors knowledge operating and also you have a tendency to Authorities, Henry climbed the new steps in the William Hill in the England. Prior activities writing, he has in addition to struck earn to the Possessions and you can you can Fund groups, where he or she is nonetheless productive. Today situated in Barcelona, Henry has got the town’s practical sporting events community and you can work golf 12 months-bullet since the an associate of the Genuine Federacion Espanola de Golf. Leaving Austin, Verstappen strengthened its head-from the the newest Motorists’ Tournament, now 57 things ahead of Norris, with five collection kept.

Fifty free spins is instantly compensated to professionals when they securely check in. Participants useful source which have brief spending plans can take advantage of game unlike ruining the lending company. The best part is the fact players can turn 50 free revolves for the real cash by the beating the fresh the new gaming requirements.

As to the reasons banks has signal-upwards bonuses

You must include in your income one numbers which you gotten that you’d have obtained within the old age had you maybe not getting disabled right down to an excellent violent assault. Include in your earnings people money you receive out of a great 401(k), retirement, or any other old age decide to the new the amount that you would has gotten the quantity in one or afterwards day regardless of whether you’d become handicapped. Your payments is completely taxable when the (a) you didn’t sign up for the price (come across Prices, later) of your own retirement or annuity, otherwise (b) you’ve got all of your costs straight back tax free ahead of 2024. But find Insurance fees to have Retired Public Defense Officers, afterwards. If the pension or annuity try completely nonexempt, enter the overall pension otherwise annuity money (of Setting(s) 1099-Roentgen, box step one) on line 5b; don’t build an admission on the web 5a. A keen HFD try a delivery produced in person by the trustee of your IRA (besides a continuing Sep otherwise Easy IRA) on the HSA.

That’s where you’ll get your Social Defense consider

Utilizing the complete number of the 3rd commission out of your online membership otherwise Page 6475 while preparing a taxation go back can reduce errors and avoid waits within the control as the Internal revenue service corrects the brand new taxation go back. Someone can view the total amount of their third Financial Feeling Payments because of their private On line Membership. Because of February 2022, we’ll as well as post Page 6475 to the address i’ve on the apply for you confirming the quantity of the third Economic Impression Percentage and you will any as well as-up money your obtained to have tax seasons 2021. Extremely eligible somebody already acquired its Financial Impression Costs. Although not, people who find themselves destroyed stimulus costs would be to opinion every piece of information lower than to choose its qualification to help you allege a data recovery Rebate Credit to have income tax 12 months 2020 otherwise 2021. That it account will secure a give already of approximately seven moments higher than the newest federal average.

Even though you just have five-hundred to expend, you could potentially still get a performance away from 2.15percent p.a great. The new prices more than try marketing prices subject to change any kind of time day by ICBC. A penalty may be implemented should your percentage is actually returned because of the the bank to possess insufficient financing. In case your matter on the internet 31 is more than the amount online 21, your repayments and credit become more than your own income tax.

We do not include the world away from businesses or monetary also provides which are available. †† Financing is not available for states who do perhaps not thing a great label to possess an equity financing. Excite contact us for of county get desires as the some constraints use. Money already financed with Firefighters Very first Borrowing from the bank Union are not eligible for this render.

Tax computation

These types of laws and regulations along with use if you were a great nonresident alien otherwise a twin-condition alien and you can both of next implement. Reporting an exchange out of a card to own a new or previously had brush car credit to a supplier at the time of sale. Choosing to remove a great nonresident alien otherwise dual-condition alien companion because the You.S. resident. If you have any modifications in order to earnings, such as education loan interest, self-a career income tax, otherwise educator expenditures. We simply cannot ensure the accuracy of the interpretation and you will shall maybe not getting responsible for people inaccurate guidance otherwise changes in the newest web page build due to the fresh interpretation software equipment. This site do not include the Bing™ interpretation software.

- When you are one’s a somewhat higher rate that it few days, don’t disregard that you ought to exit money into your most recent or family savings to help you unlock so it price.

- For many who break the rules, the fresh gambling establishment will most likely not let you withdraw their earnings.

- See Hong Leong Financing’s fixed put rates on the latest.

Of numerous discounts account, even when never assume all, reduce number of distributions you can make within a month without paying a charge. This will feel like a weight to some, but it is going to be an important limit for those who battle to remain inside a spending budget. The brand new Quontic Financial Higher-Yield Family savings now offers an attractive yield on the all the places which have partners costs, so it’s a good idea to suit your crisis money—as long as you don’t mind a completely online financial sense. Synchrony Higher-Give Deals is a superb solution for many who’re trying to find a stand-by yourself family savings.

Even though which account’s APY is repeatedly higher than the newest federal average, it’s nevertheless one of several lower efficiency on the our listing. As well as, Find only has you to branch, and you may except if they’s in your area, you acquired’t be able to availability any inside-people functions. Friend Offers try a well-circular family savings you to definitely charge pair costs while offering an aggressive give, although it’s outshined by the almost every other champions. In addition, it also provides twenty-four/7 customer service, and live cam, so it’s easy to care for issues.

For individuals who acquired buildup withdrawals out of overseas trusts or out of specific domestic trusts, score setting FTB 5870A, Income tax on the Accumulation Delivery of Trusts, to find the extra income tax. More information have been in the brand new recommendations for Schedule Ca (540) and you can setting FTB 3504, Enlisted Tribal Affiliate Degree. 1001, Supplemental Guidance to help you California Adjustments, the new recommendations for Ca Plan California (540), Ca Adjustments – Residents, as well as the Business Entity income tax booklets. A married couple otherwise RDPs will get document a shared return actually if only one to got earnings or if they don’t real time together with her all year.

In case your number you want to up in the worksheet is actually 66,819 or more, and you’ve got about three being qualified people with appropriate SSNs, you could potentially’t make the borrowing from the bank. In case your amount you’re looking up from the worksheet is actually 62,688 or maybe more, along with a few being qualified pupils that have valid SSNs, you could potentially’t make borrowing. Should your count you’re looking upwards in the worksheet is 59,899 or higher, and you’ve got three qualifying students with good SSNs, you could’t make the borrowing. Should your amount you’re looking upwards in the worksheet try 56,004 or even more, along with you to definitely being qualified boy who has a legitimate SSN, you could potentially’t make credit.

English

English