Exness ECN Review

For traders looking for an advanced trading experience, exness ecn review Exness platform offers a range of features that are designed to meet their needs. One of the most appealing options is the ECN account, which stands for Electronic Communication Network. This review will delve into the various attributes and advantages of Exness ECN, helping you understand why it could be a suitable choice for your trading endeavors.

What is Exness?

Exness is a well-established brokerage firm that has been operational since 2008. With a focus on providing cutting-edge trading solutions, Exness has garnered a significant clientele worldwide. The firm is known for its commitment to transparency, innovation, and excellent customer service. They offer a variety of account types, with the ECN account being one of the most popular among professional traders seeking direct market access.

Understanding ECN Accounts

ECN accounts provide direct access to the market without the intervention of a dealer. Instead of trading through a traditional market maker, traders can transact directly with liquidity providers, which can result in better pricing, lower spreads, and faster execution speeds. This is particularly beneficial for scalpers and high-frequency traders who rely on speed and precision in their trades.

Key Features of Exness ECN Account

1. Low Spreads

One of the most significant advantages of the Exness ECN account is the low spread it offers. Depending on market conditions, spreads can be as low as 0 pips, which is ideal for traders who want to reduce their trading costs. This competitive pricing structure enables traders to maximize their potential profits.

2. Fast Execution

Execution speed is crucial in the trading world, especially for those employing short-term strategies. Exness is renowned for its rapid trade execution, often within milliseconds. This speed ensures that traders can capitalize on market opportunities without delays, providing a distinct edge in volatile markets.

3. Access to a Wide Range of Instruments

The Exness ECN account provides traders access to a diverse array of financial instruments, encompassing forex pairs, commodities, indices, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore multiple trading strategies within a single platform.

4. Leverage Options

When trading on the Exness ECN account, traders can benefit from high leverage ratios. Depending on regulatory conditions and the nature of the instruments traded, leverage can go up to 1:2000. This makes it possible for traders to control larger positions than their initial investment, thus amplifying potential returns. However, it’s essential to be cautious, as higher leverage also increases risk exposure.

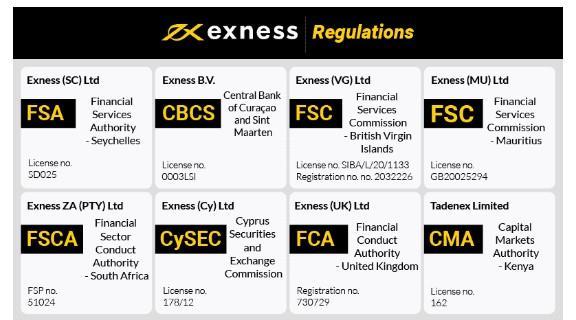

5. Security and Regulation

Security is a pivotal aspect of online trading, and Exness adheres to stringent security measures to protect client funds and data. The broker is registered and regulated by reputable financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC). This regulatory oversight adds a layer of trust and safety for traders.

Trading Platforms

Exness provides traders with access to multiple trading platforms, including the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their user-friendly interfaces and robust trading functionalities, including advanced charting tools, automated trading capabilities, and mobile trading options. The adaptability of these platforms makes it easier for both novice and experienced traders to navigate the financial markets.

Deposits and Withdrawals

Flexible and swift deposit and withdrawal methods are a crucial part of the trading experience. Exness offers a variety of options, including bank transfers, credit/debit cards, and e-wallets. Additionally, the broker prides itself on speedy processing times, often enabling instant transactions. Traders can withdraw their funds easily and quickly, a feature that enhances user satisfaction.

Customer Support

Exness is committed to offering exceptional customer service. Traders can access support 24/7 through multiple communication channels, including live chat, email, and phone. The support team is knowledgeable and can assist traders with account inquiries, technical issues, and general trading questions. This level of support is particularly beneficial for new traders who may require additional assistance as they navigate the trading environment.

Pros and Cons of Exness ECN Account

Pros:

- Low spreads, sometimes starting from 0 pips.

- Fast execution speeds suitable for high-frequency trading.

- A broad selection of trading instruments.

- High leverage options available.

- Strong regulatory compliance.

- Reliable customer support service available 24/7.

Cons:

- ECN accounts may require a higher minimum deposit compared to standard accounts.

- Trading costs can still add up with commissions in addition to spreads.

- Can be more suited to experienced traders than beginners.

Conclusion

The Exness ECN account stands out as a robust option for traders seeking a direct market approach with numerous advantages such as low spreads, rapid execution, and a diverse range of instruments. For those who are willing to embrace the complexities of trading on an ECN platform, Exness provides the necessary tools and support to enhance their trading journey. By carefully considering the pros and cons outlined in this review, traders can make an informed decision about whether the Exness ECN account aligns with their trading aspirations.

English

English